We are now eight months into the Federal Reserve’s most aggressive financial tightening campaign in decades. While the first policy hikes took place in March 2022, financial markets have been moving since Fed Chairman Jerome Powell began telegraphing interest rate hikes last November. On June 15th, the Federal Reserve hiked the Fed Funds rate 0.75%, which is the largest interest rate hike since 1994.

It is now apparent the Fed should have removed monetary accommodations sooner, especially as $5 trillion of fiscal stimulus was working its way through the system since March 2020. Three consecutive monthly Consumer Price Index prints over 8% have created market panic. If long term inflation expectations become unanchored, the global economy will enter a monetary environment that we have not experienced for several decades. Compounding this scenario is the war in Ukraine and China’s recent zero-Covid lockdowns. Their collective impact on the global supply of commodities and goods has exacerbated inflation. These two shocks could not have happened at a worse time as, the longer inflation remains elevated, the more likely it becomes embedded.

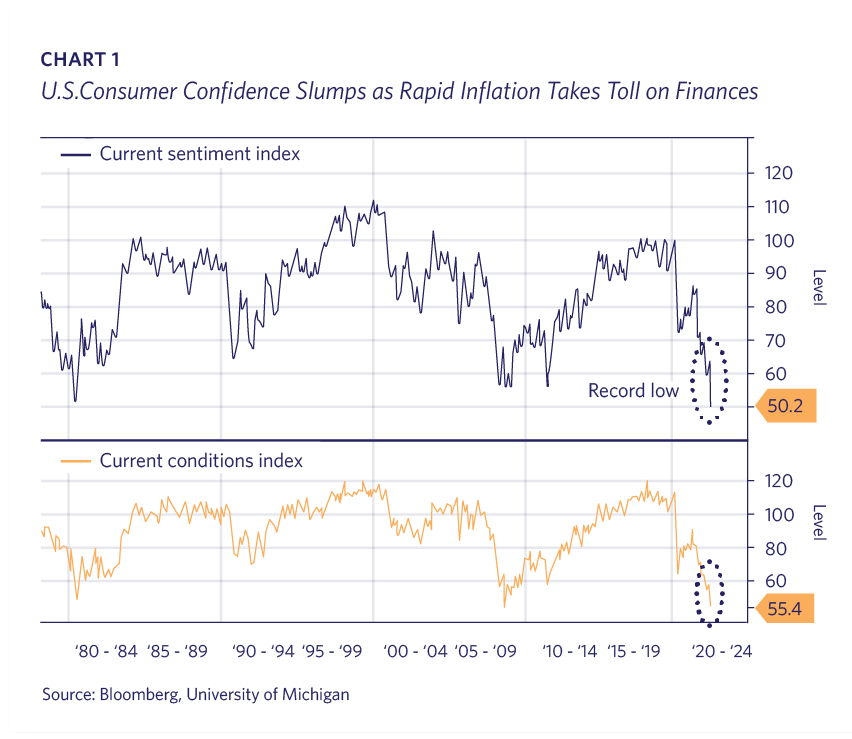

In response to this cocktail of economic and policy shocks, stock markets are plunging around the globe as they transition from a world of abundant liquidity and insatiable demand to something quite different. Not surprisingly, consumer confidence has dropped to some of the lowest levels on record (Chart 1).

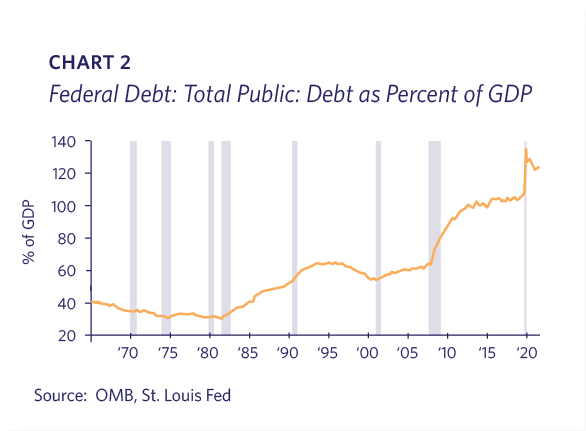

In the 1970s, interest rates exceeded 10% on multiple occasions. It is important to remember how much more indebted the U.S. economy is today versus 1978. At that time public debt to GDP was 30% versus over 120% today (Chart 2).

Minor changes in the cost of money have a much larger impact on economic activity and the federal budget today; for example, each 1% increase in U.S. government interest rates now increases the budget deficit by over $200 billion. The last time interest rates approached these levels in late 2018, the economy quickly foundered, and the Fed was forced to reverse course in short order.

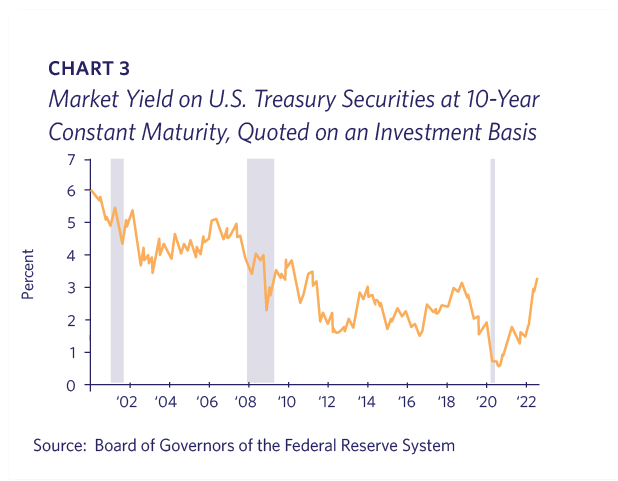

However, given the Fed is the institution tasked with fighting inflation it has a quite different mission today, as inflation was not an issue in 2018. It is raising rates high enough to materially slow economic activity. The demand for commodities and other necessary economic products, such as semiconductors and automobiles, exceeds our current ability to produce them. Constraining demand for these goods will take a considerable amount of policy tightening. In short, the global economy remains out-of-sync. The June Consumer Price Index (“CPI”) report of 8.6% created a powerful reaction in fixed income markets, as the 10-year UST approached 3.50%, the highest it has been since 2011 (Chart 3).

It is worth noting, however, that although bond yields are up sharply in 2022, long-term inflation expectations have not moved much this year and remain anchored (Chart 4).

This new higher interest rate regime has compressed valuations of publicly traded stocks and severely damaged risk sentiment. It is now clear that the froth and speculation over the last two years in Special Purpose Acquisition Vehicles (SPACs), Meme stocks, Non-Fungible Tokens (NFTs) and crypto-currencies and a subset of stocks rivaled the late 1990s dot-com mania. The $2.9M purchase of the NFT of Jack Dorsey’s first tweet (which recently had a high bid of $280) was perhaps the best example of the speculative mania that crested in late 2021. The capital misallocation of trillions of dollars will take time to unwind. However, we believe this unwinding is a healthy and necessary market adjustment, and the collateral damage to high quality assets is creating some very compelling opportunities.

In effect, we believe the Fed is being forced to clean up inflation created primarily by the largess and at times puzzling decisions made by U.S. political leadership over the last few years. We believe it is important to differentiate between the inflationary impact of fiscal stimulus and the impact of Quantitative Easing (QE), which entails the Federal Reserve buying bonds from commercial banks.

Over $5 trillion of fiscal stimulus from legislators has made it into the hands of businesses and consumers since March 2020. This massive effort to prop up demand through the pandemic lockdowns (and beyond) with direct support of consumers and businesses was unlike anything ever undertaken in modern society. There are costs to this level of direct support, of course, especially when the collective ability to produce goods and services remains compromised. Whether it is due to a shrinking workforce (Chart 5),

disrupted supply chains, Chinese zero-COVID policy, the Ukrainian war, energy prices, globalization in retreat, or a myriad of other factors is all up for debate. Eventually, however, the immutable laws of supply and demand take over, and higher prices (i.e., inflation) are the result of excess demand, at least until supply can rise to meet demand.

Nonetheless, the Federal Reserve believes it now has no choice but to attack demand by raising interest rates and slowing the economy, in effect bringing aggregate demand back down closer to aggregate supply.

The QE process, which global central banks have been using since 2009, works quite differently. With QE, commercial banks sell their bonds from their fixed income portfolios for “bank reserves” held at the Federal Reserve. These reserves are for banks only. They are not legal tender and cannot be used to transact in the real economy and critically do not directly reach the private sector. Only financial institutions with a master account at the Central Bank are eligible for these reserves. However, these same commercial banks will then rebuild their portfolios of interest-bearing securities, using the bank reserves as tender – essentially competing with the Central Bank for the same type of bonds they just exchanged. As this cycle plays out, it creates a very robust fixed income market in which interest rates are lower, risk is poorly priced by the market, and credit spreads between risky and risk-free investments are compressed.

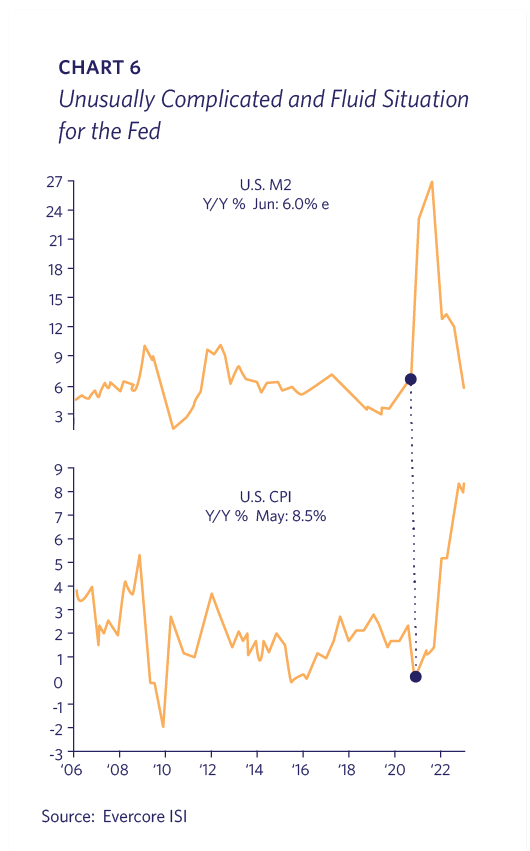

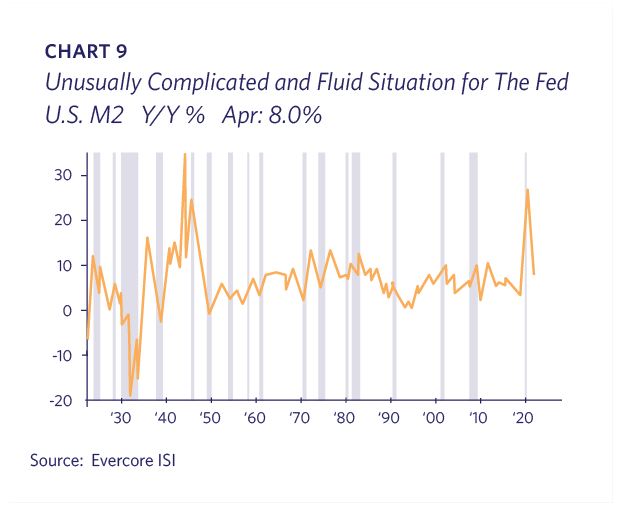

There is little doubt that QE makes for active capital markets and higher asset prices. In Lyell’s view, Central Banks have been relying too heavily on this monetary intervention and should only employ this tool as a last resort in a crisis. Allowing credit markets to price risk and money without Fed distortion is critical to a functioning economy. However, it is also likely that such an abrupt and forceful pivot from accommodative monetary policy to highly restrictive policy will create real collateral damage and an entirely new set of problems. The year over year change in the money supply has already collapsed and will likely bring inflation down with it (Chart 6).

Recession signposts are not difficult to find. The 2-10 year yield curve has again inverted, albeit for a brief period of time. Bank and bond credit spreads are widening and are likely to widen further as the Fed begins quantitative tightening this month. Real disposable income, which is defined as gross income net of inflation, is falling precipitously while consumer confidence hit an all-time low in early June.

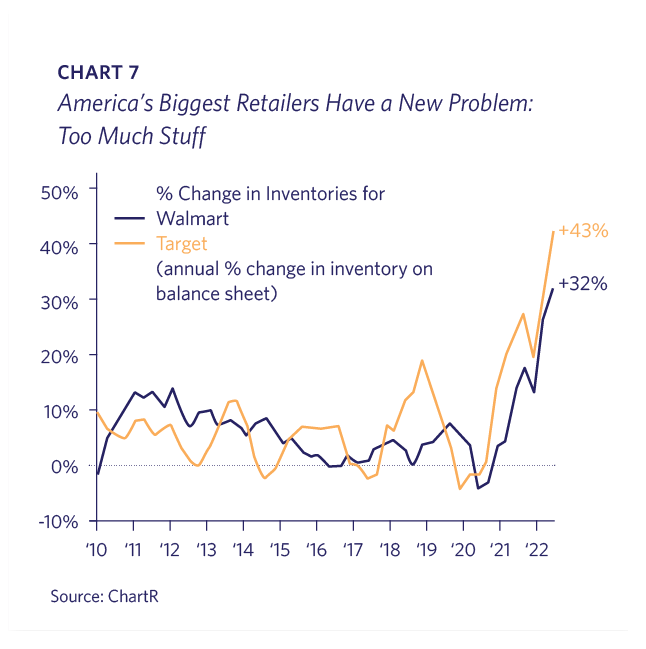

Recent disclosures from Target and Walmart reveal an interesting shift in consumer spending patterns. Inventory shortages typically end in a glut, and the only question is when. The glut is here for a subset of goods made popular during the pandemic. Discounting is just beginning. Even Amazon is cutting back on its warehouse capacity, having overinvested by incorrectly extrapolating the demand surge from the pandemic (Chart 7).

Compressed margins will likely lead to employee layoffs as companies shore up profits.

The bear market in public stocks has rippled into the venture capital universe, reducing private company valuations and in some cases making funding unavailable. There are many companies that went public over the past few years, particularly via SPACs, that have minimal revenue with large cash flow deficits; there will likely be many bankruptcies from this universe. In addition, for years the stock market rewarded many companies based purely on their revenue growth with scant attention to their expenses, cash flow or earnings; financial discipline that pares expenses and headcount is now being rewarded. All of the above developments should help alleviate wage pressure as the balance of power between employees and employers shifts towards employers again.

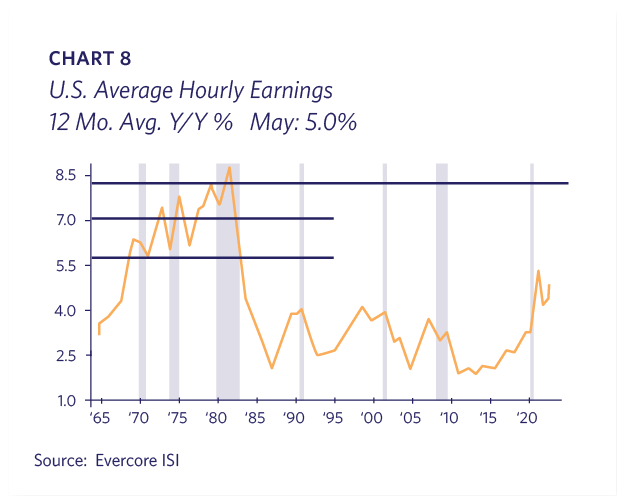

While the Fed’s largest fear is a wage price spiral, the magnitude of the problem with wages is nowhere near what it was in the 1970s. We are therefore unlikely to need a similar policy response (Chart 8).

Lyell Wealth Management still views the current period as more resembling the decade following World War II, starting in the mid-1940s, than the 1970s. This view is based on the pandemic’s massive dislocation of labor, infrastructure, trade and resources, which in many ways is similar to those experienced during a major war. In fact, the last time the United States experienced a similar explosion in the money supply was indeed in the 1940s (Chart 9).

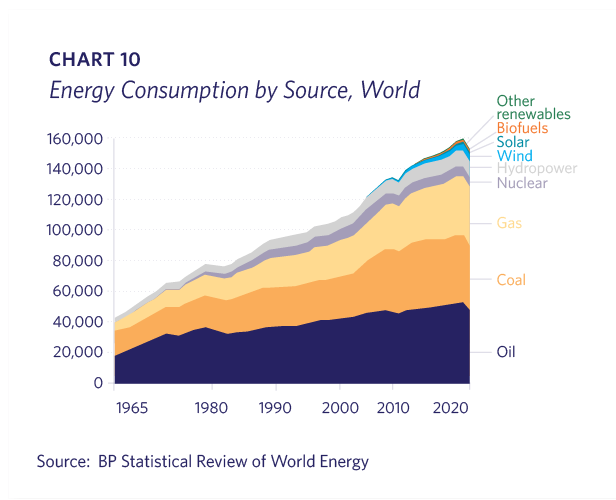

We are now seeing the trade-offs of U.S. and European energy policy and consumers are paying the price. Greater than 80% of global energy comes from burning fossil fuels (Chart 10).

Over 35% of the global population still burns biomass (wood, charcoal, and dung) as their primary energy source. While we understand the compelling reasons to pivot away from carbon to greener energy sources, renewable materials and related infrastructure are insufficient to replace carbon anytime soon. According to International Energy Agency estimates, even if current climate policies were enacted and implemented, renewables would only deliver one-third of U.S. and EU energy by 2050. The economic costs of abandoning fossil fuels at this stage of the energy transition are incalculable.

In the interim, carbon-based energy businesses have been vilified throughout much of the developed world, especially in the U.S. and Europe. Public pension funds have been encouraged – and even forced -to divest of their oil and gas investments as they violate new ESG (Environmental, Social, Governance) rules. The boom-bust nature of their businesses, and their history of environmental disasters and poor returns have starved this sector of capital in recent years. The remaining shareholders – after years of terrible returns – have demanded conservative capital allocation plans. This is limiting the U.S.’ ability to respond with more supply, as well as hampered our ability to refine the supply that we have.

Vladimir Putin is clearly not concerned with man-made climate change. Indeed, as the primary supplier of natural gas to Europe and Germany in particular, he now has enormous leverage over his European neighbors. The sanctions imposed upon the Russian economy over the last few months will take time to bite, but as any student of Russian history understands, that is not likely a concern of the Kremlin. In fact, Russia has ramped up trade with both China and India, and is selling them crude at a discount.

An old adage states that the cure for high oil prices is high oil prices. However, given the supply constraints roiling the world, and the interests of those causing the disruptions, it is likely that energy prices will remain higher for longer. Perhaps we will see a change in the West’s legislative and regulatory stance to more of an “all of the above” energy policy, but to this point there has been little adjustment made. In fact, in mid-June the Netherlands joined Germany and Austria in reverting to coal power. The relevant question appears to be: to what extent are voters in democratic countries willing to pay more for energy in the hope of an environmentally better future?

The Russian invasion of Ukraine has appeared to alter much of the leading developed economies’ views towards national defense and threatens to further fracture global alliances. The bold attack by an authoritarian adversary has been a reality-check for much of Europe and Asia. Long-standing neutral countries, such as Sweden and Switzerland, have firmly taken a side against this militarism. Meanwhile, numerous U.S. allies, such as Germany, Canada and Taiwan, that have chronically underinvested in their militaries appear ready to increase spending to become more self-reliant. Ironically, there has been movement since the Ukraine invasion for defense contractors to be considered acceptable as ESG investments. Lyell intends to add defense companies to portfolios throughout 2022, as it appears we are headed for a prolonged increase in military expenditures.

This bear market, which started last fall, has proven to be one of the most challenging investment environments in the last several decades. Longer maturity U.S. government bonds, widely perceived as being “safe,” are down over 20% from their highs last fall. The wealth destruction we have now witnessed over the last several months is literally the greatest on record (Chart 11).

Ultimately, we are of the belief that the shortage of labor, housing, automobiles, oil and gas, agricultural commodities and other goods will not be solved through higher interest rates. In the decade following World War II, the Federal Reserve and Treasury Department capped U.S. government yields at 2.50% despite inflation exceeding 10% in several years. There was an acknowledgment that the war-related dislocations were extraordinary and would need time to be resolved, and there was no reason to crush the economy over predominantly monetary causes. While this would be a radical move in a system of global capital, it is important to understand policymakers have many more tools at their disposal.

Much of what we have discussed here is widely known by investors. The question, then, is “has enough economic pain been priced in?” Only with the benefit of hindsight will we know the answer to that question, but, considering the wealth destruction that has occurred, it would seem that we are closer to the end of this market downturn than the beginning. Lyell is not in the business of predicting what will happen over the next few months as there are simply too many unknowns to regularly forecast short-term market moves. We are focused on industries and companies that we believe will thrive in both high and low inflation environments and, for those clients with cash, looking for opportunities to make purchases at discounts to long-term value. We also continue to stress the need for diversification and liquidity sufficient to navigate these volatile times, as we simply do not know how long they will last.