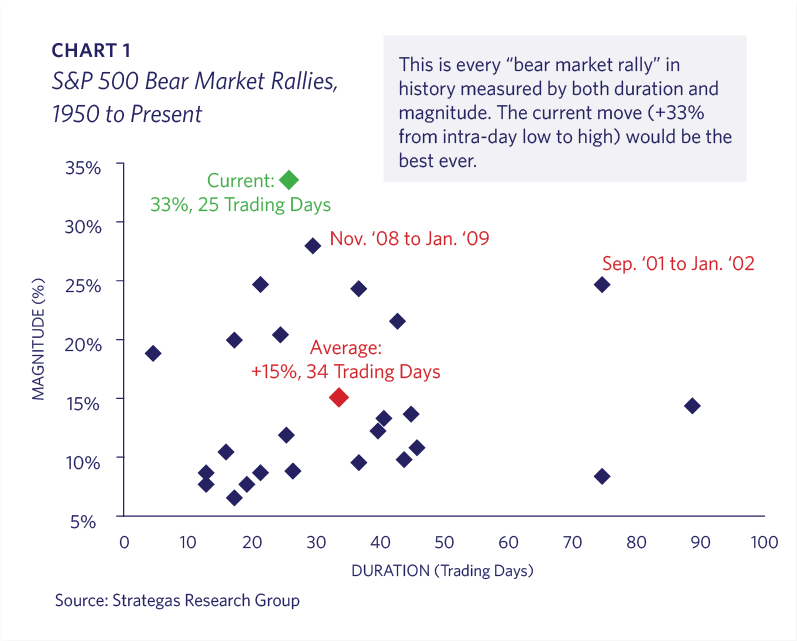

The speed with which this particular market episode has unfolded is unprecedented. It took just four weeks for the broad market to fall between 35-40%, bottoming on March 23, 2020. The current rebound, thanks to a massive liquidity program from the Federal Reserve and unprecedented legislation from Washington D.C., has not only arrested the decline but has perhaps spawned a new bull market. If this is not a new bull market, this will go down as the best bear market rally ever (Chart 1). Many observers considered the 2009-2020 bull market as the most hated bull in history, but something tells us this new bull is already much more despised. Lyell Wealth Management views the investment landscape, however, as a two-track divergent one. The pandemic is drawing a bright line between the winners and losers in this new era.

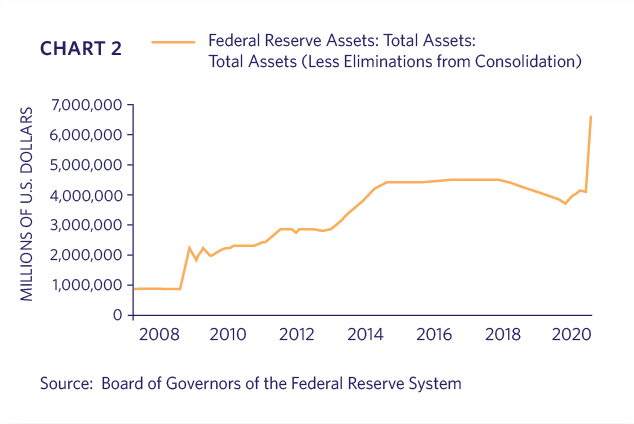

Nobody knows how this particular economic experiment will end. We’ve never voluntarily shut down the economy in this manner, and the longer it continues the more economic breakage will occur. Governments around the world are piling up debt at a startling rate to keep the economic system intact; the Federal Reserve has increased its balance sheet by 67% over the past year (Chart 2). There is a large swath of the global economy that will likely remain in some form of lock-down, no matter what politicians decree. As restrictions loosen, individuals will make their own decisions about which activities to resume, and many businesses will turn the lights back on only to shut them off again… permanently. In particular, businesses that rely on close personal interactions, especially those with high capital costs or high fixed costs, are in for a long, extremely challenging period. Airlines, cruise lines, travel and leisure businesses, hotels, dine-in restaurants, entertainment and sporting venues are in for a painful Coronavirus winter, to borrow a phrase from infectious disease epidemiologist, Michael Osterholm. This is likely why Warren Buffett’s comments last weekend were unusually somber.

Some of these businesses will adapt, and those that do will most likely be the larger deep-pockets chains that can invest in technology. Restaurants are already talking about more drive-thru options, and companies like Starbucks and Chipotle which have embraced ordering apps will likely prove quite resilient. As Buffett said, “Nothing can basically stop America.” Businesses and entrepreneurs will adapt to new circumstances, especially when their survival is at stake.

Undeniably, however, the acceleration of the digital economy at the expense of the offline economy has just been kicked into overdrive by the pandemic. Satya Nadella, the CEO of Microsoft, has recently said “we’ve seen two years of digital transformation in two months.” While Lyell Wealth Management’s portfolio strategy never had “global pandemic” as an input, numerous stocks held in our portfolios are hitting all-time highs. There is indeed a bear market in several sectors of the stock market, but it’s important to remember it is a market of stocks. The bull market is alive and well in ecommerce, mobile payments, and many other software-as-a-service companies (SaaS) to name a few. They are, in effect, stealing demand from many offline competitors at a much faster clip than before. To put it simply, PayPal still competes with cash and Salesforce still competes with pencil and paper.

We are now seeing the unmatched utility large technology companies provide to the world. “Big Tech” will exit the pandemic in a much stronger position, which is a story all to itself, but it’s difficult to imagine how different the economy would be today had this played out two decades ago without these powerful economic agents. Thankfully, as investors in individual stocks, we have the flexibility to overweight those best positioned for the pandemic economy, including these technology giants. The recent divergence in stock performance between the winners and the losers has been extreme (Chart 3).

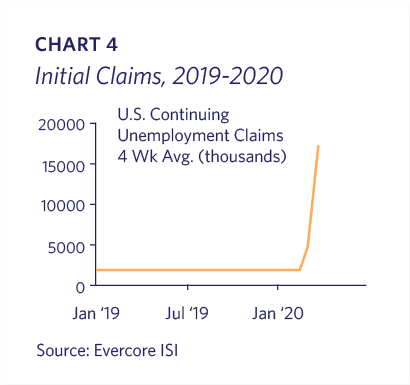

To illustrate this point, consider Amazon, a core position in Lyell Wealth Management’s client portfolios. While unemployment has gone parabolic with over 30 million filing new claims, Amazon recently hired 175,000 new staffers to accommodate the volume generated from the pandemic (Chart 4). In fact, demand on the Amazon platform was so extraordinary, they closed their warehouses to third party merchants for a month and delayed delivery of non-essential items. To hammer home this point: on their earnings call last week, Amazon claimed revenue is only constrained by their ability to meet demand. For a $1.2 trillion dollar behemoth with the scale and reach of Amazon, that is truly extraordinary.

This further illustrates the continued migration and acceleration of all forms of retail becoming more digital – even food. Cited in The Economist, “In March, Ocado, a British online grocer, saw its servers so overloaded that it suspected hackers. ‘We thought that we were under a denial-of-service attack,’ says Tim Steiner, the company’s boss. In fact, Britons were desperately trying to arrange to get food and drink deliveries for the weeks ahead. After Boris Johnson, the prime minister, announced a national lockdown the site filled three weeks’ worth of delivery slots in an hour.” This is a perfect example of Covid-19 accelerating change almost instantaneously.

Many of us in Silicon Valley take our cloud based computing architecture for granted in 2020. We shudder to think how Lyell would have continued to conduct business during the pandemic had we relied on an older computing approach that required employees to operate from one location. Suddenly, cloud based computing has become an absolute necessity for business survival. It is worth noting that many of the shelter-in-place professionals working from home have been doing so on Amazon Web Services’ cloud computing platform.

An increase in the work-from-home trend is likely here to stay, at least for a subset of the workforce. Coordination and communication surrounding projects performed by teams of remotely-housed employees will require cutting edge software technology. The stock prices of many cloud based companies reflect this accelerated trend, and we imagine this will continue for a long time. There is a good possibility large firms will find the potential cost savings of lower commercial lease payments attractive.

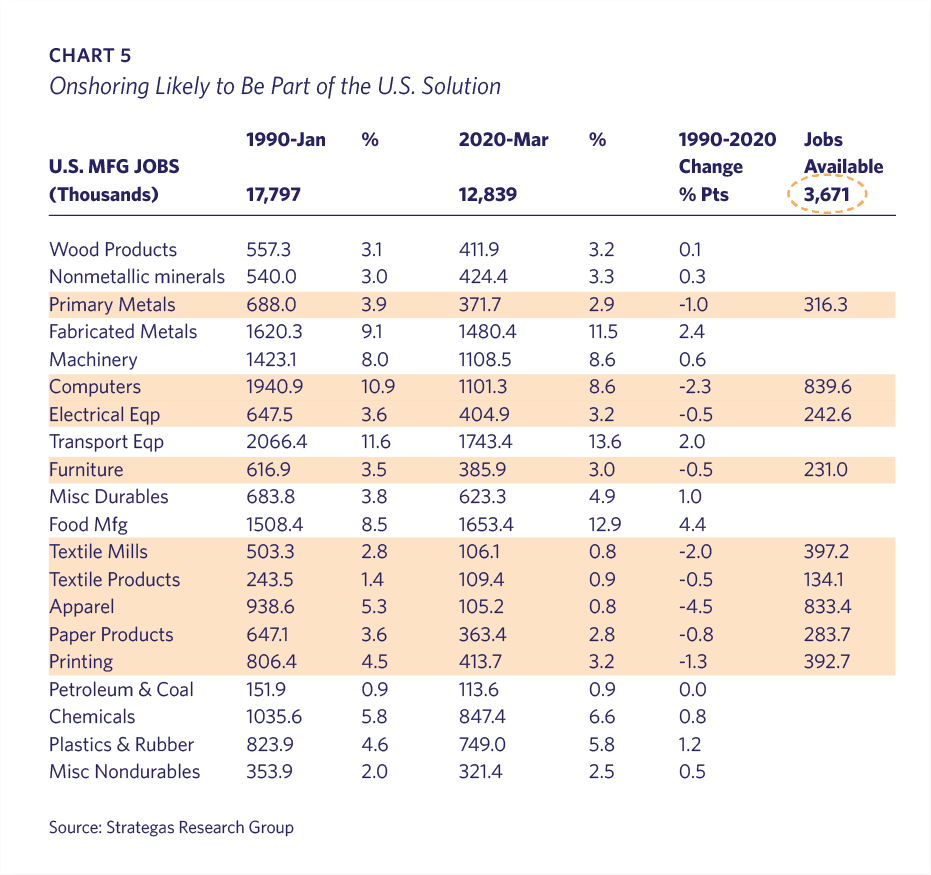

While not thematically consistent with the divergent theme, it is worth pointing out one likely change will be the on-shoring or re-shoring of American business. For the last several decades, many multinationals kept marketing, as well as research and development, at home while moving the most volatile and labor intensive activity they performed ñ manufacturing – to lower cost countries. This approach worked well from a shareholder perspective, but had obvious societal implications, and is undoubtedly partly responsible for the populist movements around the world. However, an additional cost needs to now be measured: security. Certainly most Americans were shocked to learn that many of their life-sustaining medicines are entirely dependent on China and/or India. The trade-off between capital efficiency and supply chain security is suddenly very apparent. It will be interesting to see how large companies navigate this new dynamic, and we are curious to see how the stock market will value (or not) these decisions. According to Strategas Research Partners, there could be as many as 3.6 million jobs moving back home, to say nothing of the huge infrastructure investment needed to create these facilities (Chart 5).

As investors in public markets, we are not in a rush to embrace older economy businesses without strong confirmation of value. One persistent theme we will maintain: the more digital your company, the greater likelihood it is well suited for the pandemic economy and beyond.

Lyell Wealth Management shifted to daily investment meetings once the crisis started. We continue to keep an open mind in this unusual environment and are evaluating each investment in our client portfolios in context of the new reality. While we can clearly see the carnage the virus has unleashed on the global economy, we find the resiliency of several sectors of the stock market to be very telling. Left alone, markets will allocate capital to where it is treated best. Recent commentary by firms like Apple and Facebook lead us to believe the economy, especially the digital economy, is proving more resilient than feared.

We are left with the following quote from Daniel Kahneman to sum up 2020: “The correct lesson to learn from surprises is that the world is surprising.”