The last several weeks have seen an enormous amount of market volatility. Not just the stock market – this volatility has affected every financial market in the world, from stocks to bonds to commodities and so forth.

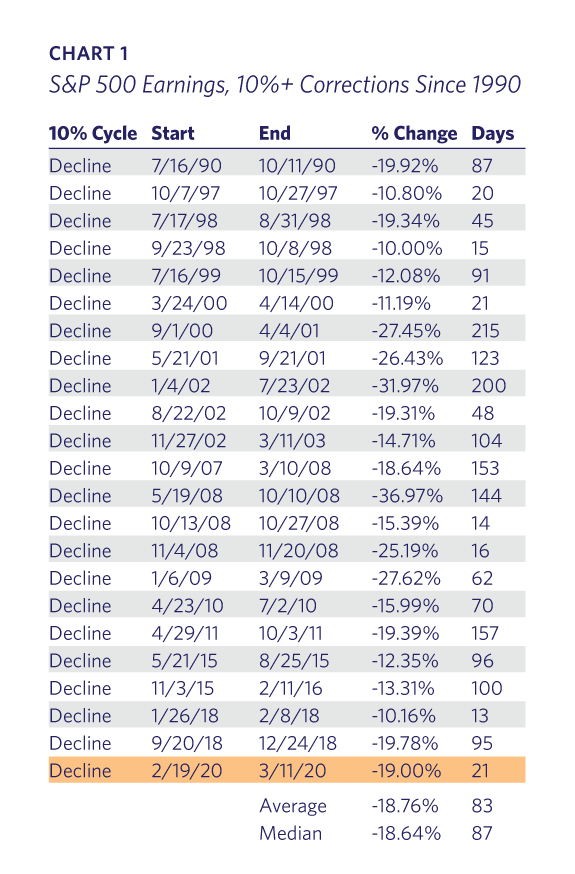

The S&P 500 peaked on a closing basis on 2/19/20 at 3,386. In the short 21 days since then, the market has fallen to a closing value of 2,741 (a decline of 19.0%) on 3/11/20. Interest rates have, if anything, seen even more dramatic moves, with the 10 year treasury yield declining from 1.57% to 0.88% over the same timeframe (hitting an intra-day low of 0.38% on 3/10.) Oil has declined from $53.73 to $32.75. Finally, the VIX Index (a measure of stock market volatility) has gone from 15.4 to 46.9. While not all of these moves are record-setting, they are all at least in the 95th percentile of all moves throughout history for each market.

The primary reason for these extreme market moves is the fear of a severe economic slowdown due to the Coronavirus. Initially the fear was of a supply shock due to China shutting its economy down. That has shifted to concerns of a demand shock as the rest of the world contends with the crisis.

A secondary, but major, contributor to the market chaos was the plunge in oil prices as Russia and Saudi Arabia effectively declared an all-out price war on Friday, March 6th. This has led to fears of solvency for small and medium sized energy companies, and subsequent concerns for any banks that may be particularly exposed to the oil industry.

A third factor that is less well understood is that there are likely fears that these extreme market moves to the downside will be self-fulfilling. We have seen this at times in the past, particularly in the credit markets. Trillions of dollars around the world are loaned out by thousands of institutions to millions of borrowers. This lending is what “greases the wheels” of the global economy. Extreme volatility in credit markets can cause them to grind to a halt, or even break. This can have significant knock-on effects in the real economy and therefore the stock market. Knowing where the thresholds are in these markets is extremely challenging. But one of the elements of this current correction that has us most unnerved is the extreme moves we are seeing in interest rates. So far, these markets appear to be bending rather than breaking. But, until the credit markets stabilize, it will be hard for the stock market to stabilize.

As you can see in Chart 1 (courtesy of Bespoke Investment Group), the severity of this decline, in terms of the price movement versus the number of days, is extreme. Not since 2008 have we seen this large a decline in so short a time. The moves in the bond markets are even more extreme, essentially unprecedented.

All of this is obviously unnerving. What is causing such an extreme move in this case? As we have commented in previous Perspectives, day-to-day trading in virtually all markets is now dominated by algorithmic trading. There are many strategies within the broader context of algorithmic trading, but the dominant ones rely on momentum. That is, when the algorithm identifies an upward-trending market, it will buy under the assumption that the trend will continue. Conversely, if the algorithm believes the market is in a downtrend, it will sell. This exacerbates market moves, both up and down.

To the extent that there is an actual human being initiating a trade, there is no question that emotion has to be factoring in here. Declining markets lead to fear amongst investors, for all of the obvious reasons. Couple that with the very real risk staring the world in the face in terms of the economic impact of the virus, and many investors are undoubtedly deciding to sell now and ask questions later.

Lyell Wealth Management’s best guess is that a lesson “learned” from previous market declines is that it is “best to get out early than to wait and get out after the market is down 10%.” That logic would lead investors to be less price-sensitive on the way out, selling faster and more steeply.

More specifically, there is a form of algorithmic strategy that has become more popular among hedge funds in recent years called “Risk Parity.” We have written about this before, primarily during the market decline in early 2018. These strategies target a certain level of risk, generally defined as expected volatility of the portfolio. As stock volatility increases, these strategies seek to lower the overall volatility of the portfolio by selling stocks and buying (presumably less volatile) bonds. No one really knows for sure, but it appears that this has been a major factor in the extreme declines in bond yields and stock prices recently. As stocks have become more volatile, these strategies have been piling into bonds, driving their yields down. It is worth noting that these strategies will be forced to turn around and reverse everything they’ve been doing, should, for whatever reason, stocks begin to move higher and/or bond yields start to move higher.

An important question, of course, is “are these market moves warranted?” We are still very early in this crisis in terms of knowing the number of people in the US that will test positive for the virus, and how our economy will hold up as we navigate the situation. As a result, the range of real-world outcomes feels very wide right now.

At this point it is hard to have confidence in any one forecast. As a result, many people are likely preparing for the worst. We have seen this repeatedly over the years. This happened most recently in the fourth quarter of 2018. Investors were worried that the double whammy of the trade war with China and the Fed raising rates too far too fast would lead to a recession. The stock market priced in a recession long before there was evidence of one. As time moved on, and it became apparent that a recession would not occur, the stock market snapped back. This led to the market being up ~30% in 2019.

Once again, the markets are pricing in a very bad scenario long before we know how things are going to turn out. In fact, we’d argue that this is as rapid of a re-pricing as we’ve seen. In many ways this makes things even more challenging ñ as we see bad news unfold in the news, the natural reaction is to consider becoming more conservative in investment portfolios. But the market has ALREADY priced in A LOT of bad news. How do we reconcile what the media reports with what has already happened in the markets?

Remember that this is coming on the heels of a 30% gain by the market in 2019, which was followed by another 5% gain to start the year. We were overdue for a pullback. In early February essentially every metric we monitor to assess the level of fear or complacency in the market was signaling a lot of complacency. It is in those moments, when very few investors are expecting markets to go down, that the market is most vulnerable. We did not know what would light the match to start the next fire, but we expected at some point the match would be lit.

This is a good reminder that markets are driven by the age-old relationship between supply and demand. If demand for stocks (buyers) is greater than supply (sellers), then stock prices will go up. And vice-versa. Market rallies tend to end when everyone that wants to buy has already bought. Corrections tend to end when everyone that wants to sell has sold. This is why extreme levels of bullishness is, perhaps counter-intuitively, a bad thing for markets. In early February, it is safe to say that the amount of cash that was waiting to buy had become quite low. Since then, sellers have overwhelmed buyers. This downturn will end once that relationship has balanced out again, and buyers begin to outnumber sellers.

A concept that Lyell Wealth Management tries to keep in mind is the idea of reflexivity. Market and economic disruptions are typically met with policy responses. This may come in the form of monetary easing by the Federal Reserve and/or fiscal policy support by the government. These actions usually help cushion the economy and markets from never-ending downward spirals. Relying entirely on the government to step in and “save us all” is a risky approach to investing (and life), so we do not assume perfect outcomes in this regard. But we do keep in mind that bad things are almost always met with some kind of a response. If the initial response proves inadequate, subsequent responses are sure to come. Right now headlines are flashing regarding various forms of stimulus, from tax breaks to Federal Reserve activity to support for anyone that loses a job. While we don’t know what form our government’s response will take, our expectation is that responses will continue until this crisis is contained.

So now you know what has happened, and Lyell Wealth Management’s views on why it has happened. The question then is, what are we doing about it all? From our inception, Lyell has taken the approach that there are going to be times when the market is down substantially, and that, while we will do our best to anticipate those events, we simply cannot anticipate them all. And we know that the worst thing that we can do for our clients’ long term financial health is to panic sell when the market is already down substantially. Every historical precedent suggests this is true. Our solution to this is to position client portfolios in such a way that neither we nor they will wish to panic sell at the wrong time. That means staying diversified and holding plenty of cash and bonds to act as ballast during these tough times. In essence, we are giving up some of the upside available during good times in an effort to cushion ourselves during the bad ones. A baseball analogy for this approach is that we know that the markets will sometimes throw us an inside fastball that we can’t avoid. Our goal is to take the pitch on the shoulder rather than in the face.

The implementation of this strategy is different for every client, specific to each client’s situation. But the theme is the same across the board. Acknowledging that this market event is likely far from over, we have been pleased so far with the results. Client portfolios are down, on average, around half of the stock market’s decline year to date. This is a function both of holding a lot of cash and bonds, as well as our stocks being down less than the market (after gaining more than the market in 2019).

We are also definitively not short-term traders. Although we felt we were due for a pullback in early February, we did not think it would be wise to start trading around that feeling. The “complacency” metrics referenced earlier have hit those levels many times in the last 10 years, yet the market has continued to move higher over time. We are aware of no investors that have repeatedly had success timing the market. We have all heard the stories of the people that “called the crash” in 2008. Kudos to them, for sure. But, in almost all of those cases, those same people have been repeatedly wrong (often to an extreme degree) ever since then. Simply put, it is extremely difficult to make those calls. And making such a call requires actually making two calls ñ one to get out, and another to get back in.

We know we are not good at market timing, so we do not try. Instead, we take the opposite approach and invest for the long term. Lyell Wealth Management’s investment horizon for our client portfolios is years, not days. Interestingly enough, this puts us in the minority in terms of investment managers these days. Being in the minority is actually a good thing. The more “crowded” a trade or a strategy is, the more money is chasing the same idea. By definition this should lower returns for that strategy. The fact that we are comfortable holding on through market turmoil, not trading in and out of investments on a regular basis, means that we can ignore a lot of the day to day noise that goes on in the markets. And we will still be invested when the market turns around and goes back up.

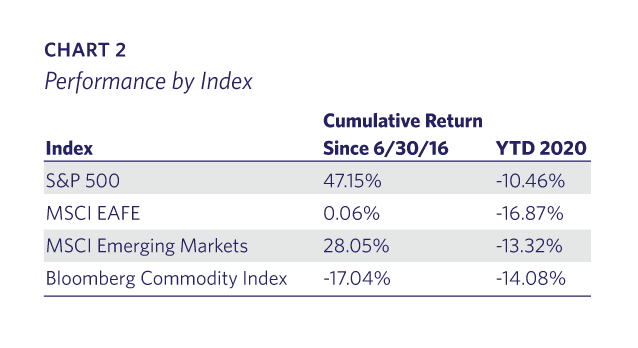

Regarding our stock performance: as you likely know, our client portfolios are dominated by U.S. stocks. We hold very little foreign stock. To the extent that we do hold foreign stocks in portfolios, we own shares in higher-growth parts of the world such as Greater China. We have held essentially nothing in Europe, Japan, or Emerging Markets other than Greater China. These decisions have helped us tremendously, as the U.S. has significantly outperformed the MSCI EAFE Index (which represents other developed economies, primarily Europe and Japan), and the MSCI Emerging Markets Index since we started the Firm as shown in Chart 2.

Note also that Lyell’s decision to have essentially no commodity holdings has also paid off tremendously. We have also been significantly underweight energy companies for quite some time.

Within our U.S. stock portfolios, we have remained diversified, with a bias towards companies that we believe have years of growth ahead of them. These disruptive companies have done very well in recent years. And our expectation is that they will continue to do well for years to come, no matter how bad the current crisis gets. Amazon is an example of a company held in most client portfolios. While its business will be negatively affected by this crisis, its long-term prospects should not change much. One could argue that, to the extent that behaviors permanently change due to this virus, Amazon may actually benefit. This is a common theme across many companies in our portfolios.

This is simply a snapshot in time. While we are happy with the way that our portfolios have performed over this period, it is of course possible that tomorrow will be the start of a new era of underperformance. We remain humble in this regard, and we also constantly test our theses to make sure that there are not reasons to change our approach.

At this time, we believe that our approach is the appropriate one for our clients. While markets are much lower today than they were a month ago, we are not actively selling bonds and buying stocks. For those clients that have new cash, we are gradually metering that cash into the market, under the belief that this too shall pass. For everyone else, we continue to hold our positions under the belief that clients’ asset allocations were where they needed to be before this downturn began.

Our best guess is that the economy will slow down dramatically in Q1 and Q2 of this year. Q3 remains a question mark. A recession (two consecutive quarters of negative GDP growth) is very possible. But we also believe that the most likely scenario is that this will prove to be a transitory event. How transitory is difficult to know. We’ve seen examples in China and South Korea that are, to an extent, hopeful. How much our country is able to contain the spread of the virus remains to be seen. The policy response by the government will be key here to how quickly our economy can jump back on its feet. With an election coming up, we know that there are incentives to do what can be done to facilitate that rebound. We will see whether policymakers have the ability and will to follow through.

Assuming we are correct, and this disruption proves to be transitory, we expect that the economy will resume its previous trajectory, more or less. In that scenario, it does not, in our opinion, make sense to sell anything today. The stock market has already priced in a recession. We believe that assuming something worse than that is not in our clients’ best interests. The indicators referenced above to help us measure the level of fear versus complacency in the market are now all decidedly registering fear. Almost all are well beyond the levels we usually see around a market bottom. Not every cycle is the same, and there is no question that things could become worse before they improve, but we feel quite strongly that now is not the time to do any selling.